Automatic Valuation of Portfolios (AVM)

Automatic and massive valuations of portfolios.

Autonomous management through the Market Navigator.

Alerts generated with cadastral data.

Idealista comparables by type and operation.

Enrichment of cadastral and energy efficiency data.

Sociodemographic and real estate market metrics.

Visualization of data in an organized and interactive format.

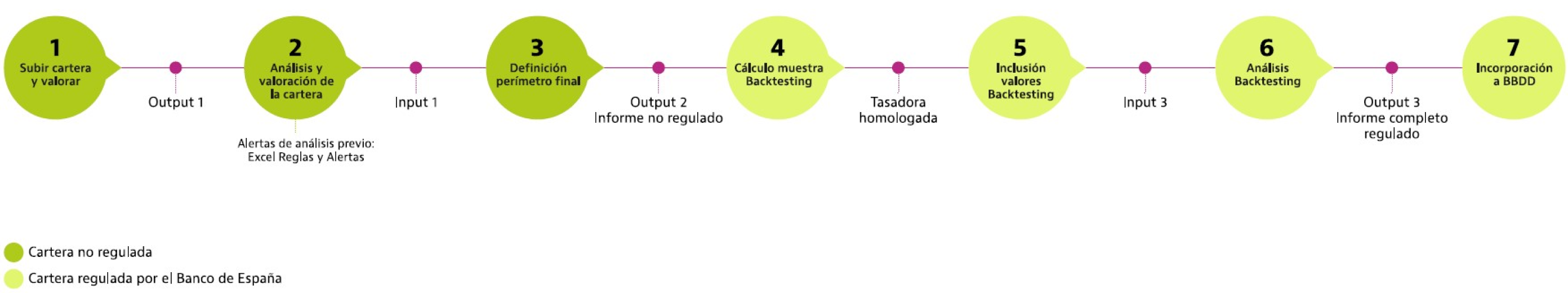

We conduct mass appraisals of portfolios using the comparison method, enriched with a Machine Learning hedonic model. For the comparison valuation, our algorithm identifies the best comparables for each property.

The valuation is calculated based on cadastral data and/or location, typology, and area. Additionally, we leverage technology for generating alerts regarding background, location, typology, area, and value; cross-referencing the original information with cadastre and previous appraisals. The entire process adheres to international valuation standards, the ECO / 805/2003 law (Article 21), and the supervisory guide for the use of automated valuation models (AVM) by valuation companies issued by the Bank of Spain.

Want more information about these services?

You can leave your details, tell us what you need, and we will contact you.