Germans are taking out more mortgages in Spain than ever before. Over the past year, they have led demand for home loans in the domestic market, and this summer their share reached record levels.

According to the latest report from idealista/hipotecas, in Q3, Germans accounted for 17.1% of all foreign mortgage applications for home purchases, placing them firmly at the top of the idealista mortgage broker ranking.

In second place are British applicants, representing 13.7% of total demand, followed by the French and Swiss (both with 8.7%) and the Dutch (8.3%). Also in the top ten are applicants from the US (5.1%), Belgium (4.2%), Ireland (4.1%), Sweden (2.6%) and Italy (1.9%). The remaining countries make up 25.6% of demand, although individually their shares are minimal. Overall, foreign applicants accounted for 3.9% of total mortgage requests.

Germany’s dominance in the Spanish mortgage market continues to grow month after month. In 2024, Germans were already the nationality applying for the most mortgages through idealista/hipotecas, although their lead over the British was narrow – just six-tenths of a percentage point (15.3% compared with 14.7%). Now, that gap has widened to 3.4 percentage points, marking the highest level recorded in the historical series.

Alongside the Germans, French buyers also stood out last summer, accounting for 8.7% of foreign mortgage demand – the third-highest figure in the ranking, tied with Switzerland. This represents a two-percentage-point increase in just three months. However, unlike Germany, French demand remains below its record high: in the summer of 2023, French applicants represented more than 10% of all foreign mortgage requests.

Meanwhile, the United Kingdom and the United States are losing ground in the rankings. Although British nationals remain the second-largest group applying for mortgages in Spain, their current share of 13.7% is the third lowest in the past 11 quarters, interrupting the upward trend they had been experiencing so far in 2025.

In the case of US citizens, the figure marks the lowest level in the historical series. Since 2023, their share has fluctuated between 7.5% and 10%, making this the first time it has fallen to around 5%. As a result, Americans have dropped out of the top five, now ranking sixth overall.

Another country gaining prominence in 2025 is the Netherlands, which continues to strengthen its position, overtaking the US and consolidating its demand at over 8%. Sweden has also advanced in recent months, surpassing Italy. Swedish buyers not only request the largest average loans – nearly €210,000 compared with the overall average of €176,400 – but are also those seeking the highest-value homes, averaging €301,000, well above the general average of €243,000.

What mortgages are required?

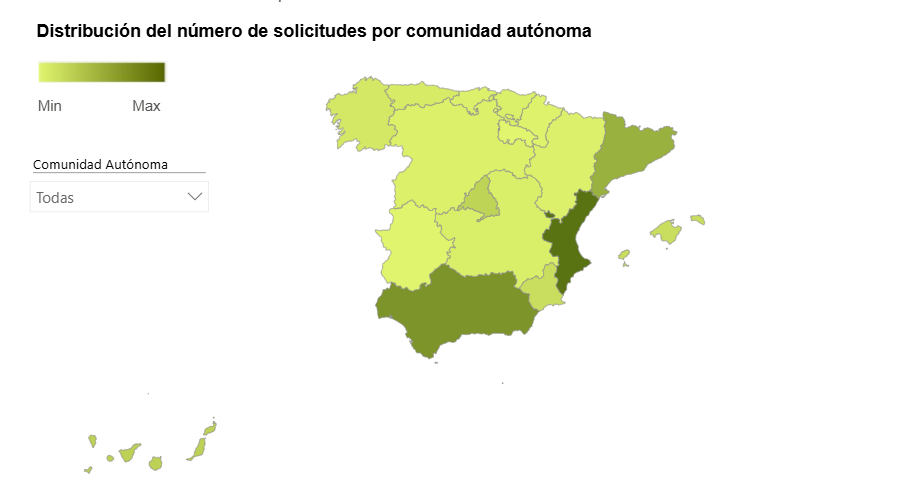

According to the idealista/hipotecas market study, foreign mortgage applications are primarily for buying homes located in coastal areas. The Valencian Community is the most popular region, which accounts for 27.5% of demand, followed by Andalusia (20.5%) and Catalonia (14.6%). Outside the top three are the Canary Islands (7.6%), Madrid (7.2%), the Balearic Islands (4.9%) and Murcia (4.9%).

The average mortgage requested by foreign applicants stands at around €176,140, and in most cases, they seek loans below €200,000 to purchase their desired property (70.8%). The average property price is approximately €244,000, representing a 2% increase on last year’s figure.

Meanwhile, foreigners applying for mortgages in Spain have an average monthly household income of €6,422, although this varies significantly by nationality. Swiss and American applicants top the list, both earning over €9,000 per month on average. They are followed by Swedes (€7,350), while Italians have the lowest average income among the top 10 nationalities, being the only group below €5,000.

On average, foreign mortgage applicants are 43 years old and request around 75% financing, while maintaining a low debt level of just 25%.