ING is upping its stakes in the real estate sector in view of its imminent recovery.

According to a recent study by the Dutch bank on real estate, "the sector is on track for further recovery", driven by factors such as anticipated interest rate cuts in the eurozone and a stabilisation in property valuations.

The bank adds that "solvency indicators are unlikely to deteriorate much further, and credit risk is now largely limited to certain sub-sectors (like offices) or specific cases." ING expects increased investor interest in the sector following months of low exposure amid economic and monetary uncertainty.

ING notes that these factors "could generate additional demand for real estate assets," predicting that "2025 will be the year the real estate sector finally turns around". The bank adds, "We are increasingly optimistic about the market outlook." However, its analysts caution that the sector still faces significant hurdles.

“The real estate sector has not fully emerged from the crisis, as Europe’s slowing economy and weaker consumer spending may curb demand, while office markets continue to struggle with rising vacancy rates in certain areas. Furthermore, investors are likely to remain cautious, with some companies still needing to deleverage and address upcoming debt maturities,” the study concludes.

More transactions and debt issuances

The Dutch bank also anticipates a rise in real estate transactions and investment in the coming months.

According to its estimates, investment volumes could grow by around 10% this year compared to 2023. For 2025, ING forecasts “a stronger recovery in transactions as yields and valuations stabilise, and investors move to capitalise on market opportunities.”

Additionally, ING expects “an upturn in mergers and acquisitions (M&A)” and increased debt issuance by real estate companies. While many issuers have recently opted for alternative financing, such as bank loans, capital increases or asset sales, the bank foresees a “partial reversal of this trend,” with more issuers returning to the bond market.

Their data indicates that euro-denominated real estate bond issuance has already surpassed initial expectations this year, reaching almost €19 billion by October. For 2025, ING projects this trend to continue, with issuance climbing to €30 billion, driven by higher transaction volumes and more favourable bond market conditions. Debt refinancing is also expected to play a significant role.

The study highlights that maturities of euro real estate bonds totalled €18.7 billion in 2023, will reach €20.4 billion this year, and are set to rise to €23.9 billion in 2025 and €27 billion in 2026. With 65% of these maturities due in the first half of each year, many companies are likely to tap the markets to raise capital and refinance their near-term obligations.

Record green financing

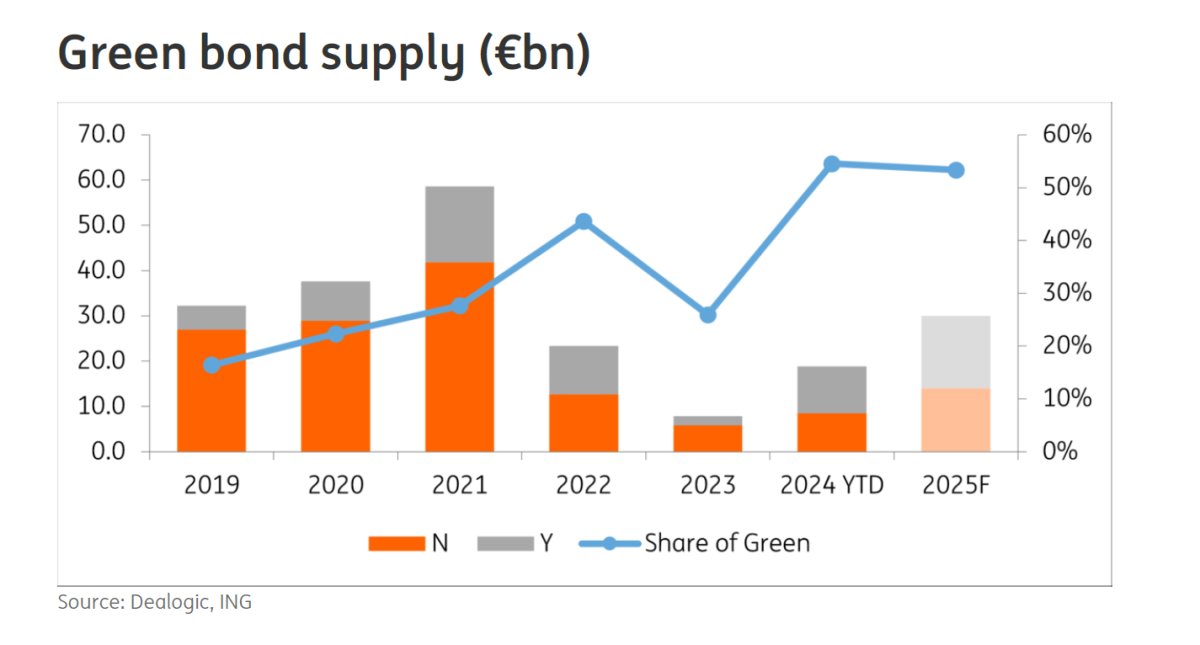

The document also reveals that, for the first time, real estate companies have issued more green bonds than traditional ones. This year, the sector has raised €10.4 billion in green bonds compared to €8.4 billion in traditional bonds. This shift could signal a broader trend in the market.

“In previous years, green bond issuance has accounted for less than 50% of total supply, but we do not expect 2024 to be an exception, as the shift towards green financing is likely to continue long-term,” the study notes.

ING analysts emphasise that “sustainability is becoming an essential consideration for real estate finance, driven by environmental concerns and regulatory pressure that increase demand for sustainable development practices and financing. Additionally, a growing portion of capital expenditure (capex) will be directed towards sustainability and environmental, social and governance (ESG) initiatives, as real estate companies invest in energy efficiency and reducing the carbon footprint of buildings”. Consequently, the industry’s heightened focus on sustainability, coupled with rising demand for green bonds, is expected to result in approximately €16 billion in green bond issuance in 2025.