One of the main concerns for any foreign property buyer is how the exchange rate will affect the final cost of the purchase.

If the sale is to be completed in euros, but the buyer’s income and savings are in pounds, dollars, or another currency, the exchange rate can fluctuate between the date of the deposit and the signing of the deed — a process that can often take several months.

To manage this risk, there is the so-called ‘forward contract’, which allows the buyer to fix the amount they will pay for the property in their local currency, no matter how the exchange rate moves. This service is now available through idealista’s new currency exchange platform.

What is a forward contract?

A forward contract is an agreement to reserve an exchange rate today for use at a later date, making it a type of forward agreement. It is particularly useful when a buyer reserves a property but will not complete payment for several months (usually up to 12 months).

The main advantage of this contract is that it protects against market fluctuations and allows you to plan your budget without surprises. In other words, it guarantees the amount you will pay for the property in your own currency.

For example, suppose a British buyer has a budget of £250,000 for a property. If the current exchange rate is £1 = €1.13, they would pay €282,500 for the transaction.

However, if the purchase is completed a few months later and the pound has weakened to €1.10, paying for the same property would cost £256,818 — an extra £6,818. With a forward contract, the exchange rate is fixed at the time of the reservation, so the buyer knows from the outset exactly how much the property will cost.

When a forward contract makes sense

This type of contract is recommended when there may be at least two months between the deposit and the signing of the deed, typically between 2 and 9 months.

It is also useful when the buyer has a defined budget and wants to avoid last-minute surprises, or when the transaction is large and the potential savings could be significant.

Additionally, it is particularly suitable for buyers whose income or savings are in another currency — whether dollars, pounds, krona, yen, lira, etc. — but the transaction will be conducted in euros.

Another common scenario is when the payment is made from the buyer’s home country while the property purchase is completed in Spain.

It is important to pay attention to the exchange rate, deadlines, deposit, and fees, and to have everything documented before signing.

Step-by-step process

To hedge exchange rate risk through Idealista, follow these steps:

- Registration and verification – Create an account with idealista’s currency partner, Currencies Direct, and provide the basic documentation to register as a client.

- Transaction confirmation – Once the exchange rate is accepted, the user receives a Deal Confirmation detailing the agreed rate, the expiry date, applicable fees, and any deposits required. This confirmation formalises the contract.

- Deposit – For a forward contract, a security deposit may be requested to “reserve” the exchange rate.

- Using the forward contract – Funds purchased via the forward can be used for later payments (e.g., the deposit, interim payments, or the final balance of the deed). It is also possible to transfer the funds to a beneficiary (seller, notary, lawyer, etc.) if their details are provided at least two working days before the expiry date. If this deadline is not met, payments can be held in a segregated bank account and converted to electronic money in your wallet until the user specifies the destination.

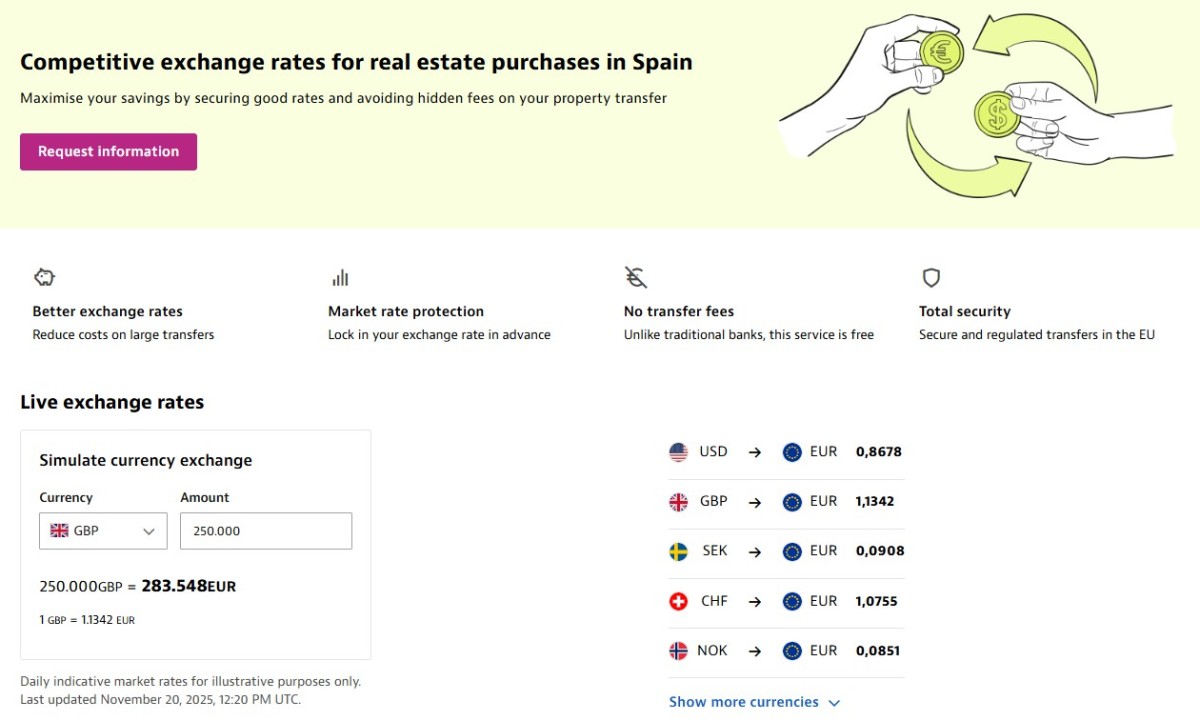

- Final transfer for the purchase – When the time comes, the user sends the funds to the secure account managed by Currencies Direct, which then transfers the converted amount to the account specified for completing the property transaction. This service is EU-regulated, with no transfer fees, and offers competitive exchange rates for property purchases in Spain. On average, it saves between 3% and 5% compared to standard bank rates.