Germans are gaining increasing prominence in the Spanish housing market. In 2024, they were the third most active foreign nationality in terms of property purchases in Spain and also ranked third in terms of the highest average prices paid. At the beginning of this year, they have further consolidated their position as the nationality with the highest number of mortgage applications.

According to the latest report from idealista/hipotecas, in Q1, German citizens accounted for 16.6% of all foreign demand for home loans – the highest proportion of any nationality included in the idealista mortgage broker ranking.

In second place are British applicants, who made up 14.2% of the total, followed by the Swiss (8.7%) and Americans (7.7%). Also featured in the top ten are applicants from France (7.5%), the Netherlands (6.9%), Ireland (4.4%), Belgium (4%), Italy (2%) and Sweden (1.9%). The remaining countries collectively represent 26.1% of foreign demand, although their individual shares are relatively small. Overall, foreign buyers accounted for 3.6% of total mortgage applications in Spain.

Germany’s lead has grown stronger in the first three months of the year. While they were already the nationality with the highest number of mortgage applications via idealista/hipotecas in 2024, their advantage over the British was modest – just 0.6 percentage points (15.3% versus 14.7%). However, this gap has now widened to 2.4 percentage points.

Another notable shift in Q1 is the rise of applicants from Switzerland, the United States and France. These nationalities have overtaken Dutch applicants, who have fallen to sixth place in the ranking, despite having been the third most active nationality in the market last year.

Looking at the performance of the main nationalities in recent quarters, it’s clear that Germans have been steadily regaining ground lost to the British, while demand from American, French and Swiss buyers has remained relatively stable.

They apply for mortgages below the average

According to the idealista/hipotecas study, foreign buyers in Spain apply for an average home loan of €180,601, although this figure varies notably by nationality.

Germans, for example, request significantly less than the average, with an average mortgage of €148,946 – the third lowest among the nationalities analysed. Only Italians (€142,423) and Swedes (€147,278) apply for smaller amounts. At the other end of the scale, applicants from Switzerland and the United States typically take out loans exceeding €200,000.

Another key area of difference is the average income of non-resident households applying for mortgage loans. Their monthly earnings not only far exceed the average for Spanish applicants (€3,379), but also vary significantly by nationality. The average income for all foreign applicants stands at €6,572 per month. Once again, Switzerland and the United States top the list, with monthly incomes exceeding €9,000, while Italian applicants report the lowest, at under €3,900 per month. In general, EU nationals tend to have lower incomes –Germans, French, Belgians and Irish applicants all earn less than €6,000 on average.

In contrast, differences in the average age of mortgage applicants are minimal, with most aged between 40 and 42. Similarly, the proportion of the property price financed by a mortgage is fairly consistent, ranging from 71% in Sweden to 76% in France. German applicants typically seek to finance 73% of the purchase price and tend to opt for a mortgage term of 40 years.

Coastal regions and fixed-rate mortgages attract the most interest

The Mediterranean coast remains the top choice for non-residents applying for a mortgage to purchase property in Spain.

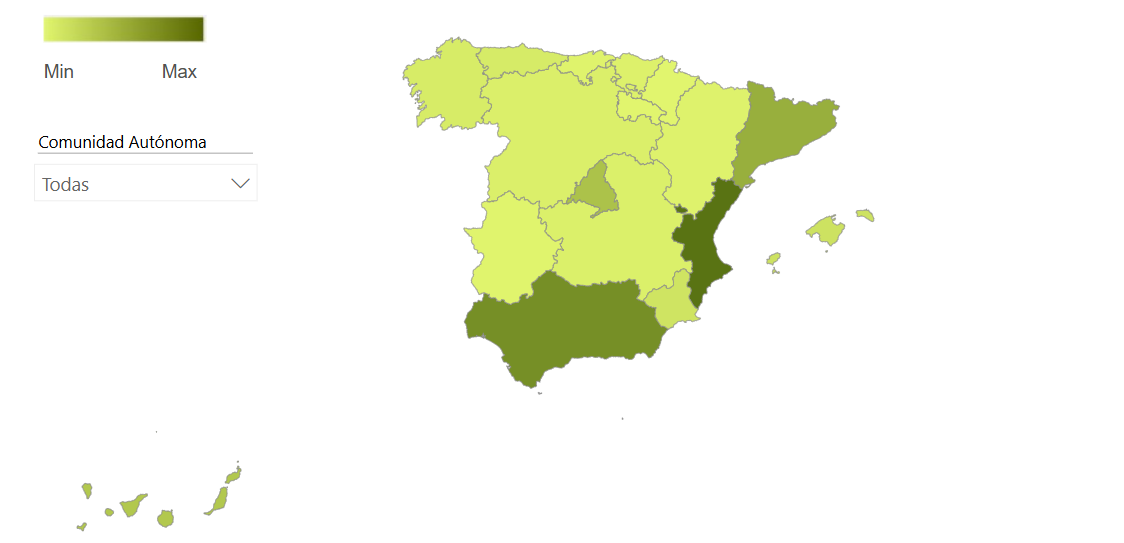

According to data from idealista/hipotecas, the Valencian Community leads the way, accounting for 26.8% of all foreign mortgage applications. It is followed by Andalusia (21.1%) and Catalonia (14.5%). Other popular regions include Madrid, the Canary Islands, the Balearic Islands and Murcia.

Fixed-rate mortgages continue to dominate the market, making up 84% of completed mortgages, compared to 12% for mixed and 4% for variable rates. This trend is also seen among Spanish buyers, with 73% choosing fixed-rate mortgages in Q1 and 27% opting for mixed rates. Variable-rate mortgages have all but disappeared from the market.

Larger loans and higher incomes

Another insight from the idealista mortgage broker’s report is that the loan amounts and incomes of foreign households who complete a financing transaction are significantly higher than the average figures for all applicants.

In Q1, the average loan amount for transactions involving foreigners reached €204,243, compared to the requested average of €180,601.

Meanwhile, household incomes for these buyers stood at around €10,900 per month, over €4,000 higher than the average applicant, while property purchase prices approached €350,000, the highest recorded in the idealista/hipotecas series.