Over the past year, more foreigners have bought properties in Spain, often breaking records. According to notaries, citizens from countries like the USA, Portugal, Italy, Morocco and Ukraine have bought more properties than ever in Spain, while the average price paid by all foreign buyers has reached historic highs. Many are requesting mortgages to finance the purchase, with executives and business owners being the most prominent profiles. Coastal areas are still preferred, while Madrid stands out in the luxury sector. The end of the "golden visa" was also approved this year.

Notary data show that foreigners bought 69,412 homes in Spain during the first half of 2024, 1.8% more than the previous year, representing 20.4% of total transactions, meaning that they bought one in five homes in Spain.

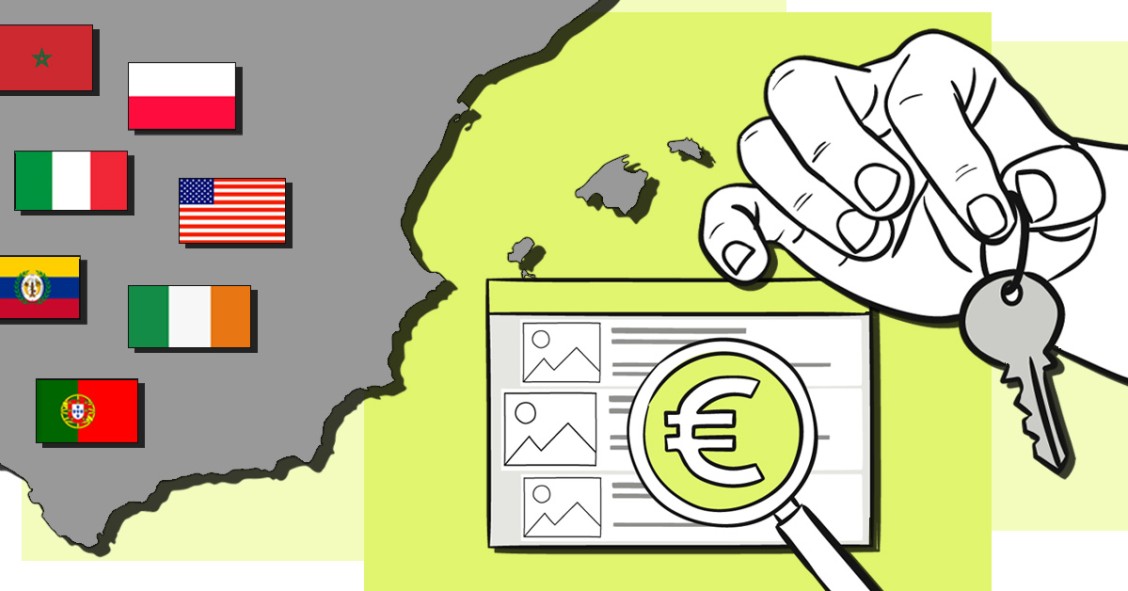

Record prices and transactions for some nationalities

Between January and June, the average price paid by foreigners reached a record high of €2,249/m2, increasing by 7.4% compared to the first half of 2023. Specifically, non-residents paid €2,895/m2, an increase of 11.4% year-on-year and the largest growth since 2021. Foreign residents paid €1,734/m2, exceeding €1,900/m2 of 2008, while Spanish buyers paid €1,659/m2.

In addition to rising prices, several nationalities have also set new transaction records. According to the historical notarial series, which dates back to 2016, the first half of 2024 saw property transaction records broken by citizens from eight countries across different continents.

In Europe, notable purchases were made by Irish, Italian, Polish, Portuguese and Ukrainian buyers, while in North and South America, Americans and Colombians led the way. Moroccans stood out in Africa. Additionally, the "non-EU" category reached its highest level to date.

Among all the nationalities, the most prominent in terms of transaction volume is Morocco, with its citizens purchasing 5,452 homes in Spain in the first half of the year. This accounts for nearly 7.9% of all foreign-led transactions. Morocco is the second most prominent country of origin, only surpassed by the United Kingdom (8.4% with 5,864 transactions) and ahead of Germany, which ranks third with 6.8%.

The second most significant nationality in terms of sales volume is Italy, with 4,332 homes purchased by Italians up to June, followed by Poland (3,105) and Ukraine (2,058). The number of transactions from Ukraine has surged by 70% in just two years, largely due to the Russia-Ukraine war.

Below the 2,000 mark are Americans (1,363 transactions), the Irish (1,186), Colombians (1,073) and Portuguese (921). Meanwhile, the "non-EU" category collectively accounts for over 7,700 sales.

The Med, foreigners' area of choice

What has not changed in 2024 compared to previous years is foreigners preferring to buy homes on the Mediterranean coast. The Spanish coast continues to arouse a lot of interest, especially in buying a second home.

The Valencian Community was the autonomous community with the most transactions in the first half of the year and broke the record for sales by foreigners, after reaching 21,224 operations, representing more than 30% of the total purchases made by foreigners in Spain. Since 2016, one in four transactions has been made by international buyers in the provinces of Castellón, Valencia and Alicante, confirming that this region is preferred by foreigners.

The next most prominent regions were Andalusia (12,637 transactions) and Catalonia (10,465). According to idealista data, in locations within Roses (Girona), Calpe (Alicante) or Andratx (Balearic Islands), foreign relative demand exceeds 65% of the total searches and interactions carried out on the real estate portal, where nationalities such as French, Dutch or German stand out.

Following the three Mediterranean autonomous communities, Madrid and the Canary Islands rank next in terms of the highest number of property transactions involving foreigners, each recording just over 5,000 units. However, among the top five autonomous communities by transaction volume, only the Valencian Community managed to set a new record.

For Madrid, this marks the second-highest figure since 2016, while Catalonia achieved its third-best result, according to notarial statistics.

In addition to the Valencian Community, several other regions achieved record figures for property sales to foreigners. Murcia led the way with 3,840 transactions, followed by Castilla y León, which recorded over 1,280. Meanwhile, Galicia and the Basque Country also posted noteworthy numbers, surpassing 900 and 800 transactions, respectively.

While the Valencian Community, Andalusia and Catalonia remain the most popular destinations for international buyers, other areas, such as the Balearic Islands and Madrid, are also attracting attention, particularly in the luxury segment.

Mallorca, for instance, is one of the world's top destinations in the high-end property market. It is especially favoured by buyers from Germany, the United Kingdom, Scandinavia and the United States, who show strong interest in second homes, including villas, sea-view apartments and country estates.

Madrid is steadily gaining prominence in the prime real estate market, particularly among international investors. This comes at a time when the profitability of the luxury property sector in major US cities such as New York, San Francisco and Miami is on the decline. The Spanish capital has emerged as a hub for foreign investment, setting itself apart from Barcelona, where local investors continue to dominate.

Notably, Madrid has, for the first time, been ranked as the second most attractive major city in Europe for real estate investment, second only to London. In recent months, the city has also drawn attention for its promotion of the so-called "Mbappé Law", a regional initiative aimed at attracting foreign investment – though this does not extend to real estate investments.

In mid-November, the Madrid Assembly approved a regulation offering a 20% deduction on the regional personal income tax rate for foreign investors who transfer their tax residence to the Community of Madrid after spending at least five years outside of Spain. This measure will apply to relocations effective from 2024.

To qualify, investors must maintain both their investment and tax residence in the region for a minimum of six years. The regulation excludes real estate investments, investments in entities domiciled in tax havens and those made by individuals who hold executive roles or work within the companies in which they invest. Eligible contributions include investments in securities, bonds, treasury bills, shares of listed and unlisted companies and contributions to limited companies, among others.

What foreigners want to buy

When it comes to housing preferences, foreign buyers typically seek homes with a southwest orientation, aiming to maximise sunlight, enjoy extended hours of daylight, and take in the sunset. In contrast, national buyers tend to prefer southeast-facing homes, which allow them to enjoy the sunrise while minimising heat exposure during the summer months.

According to data from the Property Registrars, foreign buyers also show a clear preference for larger homes compared to Spanish purchasers. Notably, 34.5% of property purchases by foreigners involve homes exceeding 100 m². Among them, American buyers lead this trend, with 50% of their purchases falling into this category. On the other hand, buyers from Argentina, Italy and France tend to buy smaller homes, often opting for properties under 40 m².

In terms of property prices, 9.7% of purchases made by foreign buyers exceed €500,000, with an almost equal split between EU and non-EU purchasers. The regions leading in high-value transactions include the Balearic Islands, the Community of Madrid, Andalusia and Catalonia.

This strong performance underscores the significance of the Spanish real estate market for foreign buyers, whether for residential purposes or investment opportunities.

Business owners and executives request more mortgages

Recent studies reveal that only a third of foreigners finance property purchases in Spain, indicating that the majority of transactions are completed without a mortgage. This suggests that these buyers are less affected by fluctuations in the economy and interest rates.

Among the foreign buyers who do take out a mortgage, the most prominent groups include high-net-worth individuals such as business owners and executives, as well as salespeople. Most of these buyers prefer mixed mortgages and seek financing primarily for purchasing second homes in coastal areas.

Foreign mortgage applicants in Spain report an average household income of €6,566 per month, a notable increase compared to the €4,726 average at the start of 2022. Approximately 40% of these applicants earn more than €6,000 per month.

The majority (75%) of mortgage applications are for amounts below €200,000, with only 5.4% seeking financing of over €400,000. On average, the financing requested represents 74% of the property’s purchase price, while the average debt level stands at 24%, well below the 30–35% threshold considered reasonable by experts.

Overall, foreign buyers are generally in the market for more expensive homes than Spanish buyers.

Goodbye golden visa

Another noteworthy development this year regarding foreign buyers and real estate has been the end of the so-called "golden visa".

The PSOE and its parliamentary allies leveraged the passage of a law in the Justice Commission to abolish the "golden visas". These special visas, introduced under the government of Mariano Rajoy, were granted to non-resident foreigners from outside the European Union who invested more than €500,000 in property.

During the previous legislature, former Minister and current Governor of the Bank of Spain, José Luis Escrivá, indicated that the government was working on revising golden visa conditions. In April of this year, Prime Minister Pedro Sánchez announced the government's intention to withdraw it.

It wasn’t until the end of the year that the government found a legislative path to abolish golden visas. The change was introduced through an amendment added behind closed doors to the bill on measures to improve the efficiency of public justice services. This bill was approved in a report on 30 October, without the participation of PP deputies, who had suspended their activities following the tragedy caused by the storms in Valencia and other parts of Spain.

The Congress of Deputies approved the legislation on 14 November. However, it was vetoed by the Senate at the beginning of December, leading to its return to the Lower House. On 19 December, the legislation was approved by an absolute majority in the Plenary Session. With this, the text was ready to come into effect, pending publication in the Official State Gazette (BOE).

Between January and October of this year, a total of 780 golden visas were granted, with an average investment of €657,204. Since 2016, nearly 11,000 visas have been issued, according to the Ministry of Housing and Urban Agenda (MIVAU). Real estate experts have ruled out the possibility that the abolition of the golden visa scheme will have a significant impact on Spain's residential market.