House prices show no signs of slowing in the short term. According to economic and real estate experts, the upward trend is accelerating due to strong demand, improved economic prospects and falling interest rates. In much of the country, house prices could see double-digit growth in 2025.

At least, that is the expectation of CaixaBank Research. The financial institution's research department has recently updated its housing market forecasts, predicting higher sales and a greater price increase than anticipated last autumn.

Specifically, it predicts a national rise in prices of between 5.9% and 7.2%, depending on whether the statistics from the Ministry of Housing and Urban Agenda (MIVAU) or the Spanish Statistics Institute (INE) price index are used as a reference. However, in one in three localities, the increase could exceed 10%.

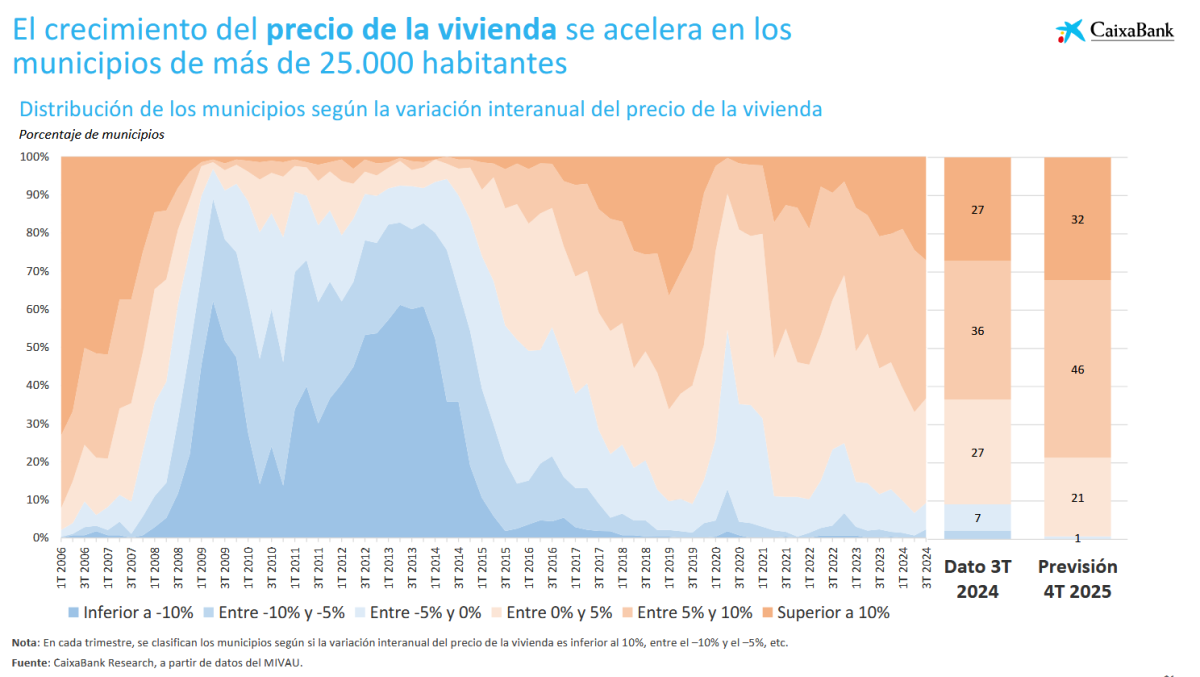

According to data from the portfolio led by Isabel Rodríguez, up to 27% of towns with more than 25,000 inhabitants in Spain saw a year-on-year price increase of more than 10% last summer. In 36% of these towns, the increase ranged between 5% and 10%, while 27% experienced a rise of between 0% and 5%. Prices fell in only 10% of localities – 7% saw a decline of less than 10%, while the remaining 3% experienced a drop of more than 10%.

After extrapolating the behaviour of housing prices in towns with more than 25,000 inhabitants, CaixaBank Research expects an acceleration in the market. By the end of this year, up to 32% of localities are forecast to register a double-digit year-on-year increase, compared to 27% in the third quarter of 2024.

It also predicts a sharp rise in the number of towns where prices will increase by between 5% and 10%, growing from 36% last summer to 46% by the last quarter of 2025.

As a result, 78% of towns with more than 25,000 inhabitants will experience price increases of over 5% this year, while only 1% will see price declines, which will be moderate (up to -5%).

According to the bank's research department, the price increases will be most noticeable in tourist areas and large cities, which serve as economic and employment hubs, experiencing the greatest imbalance between supply and demand. Large metropolitan areas will also be prominent in this trend.

Access to housing worsens

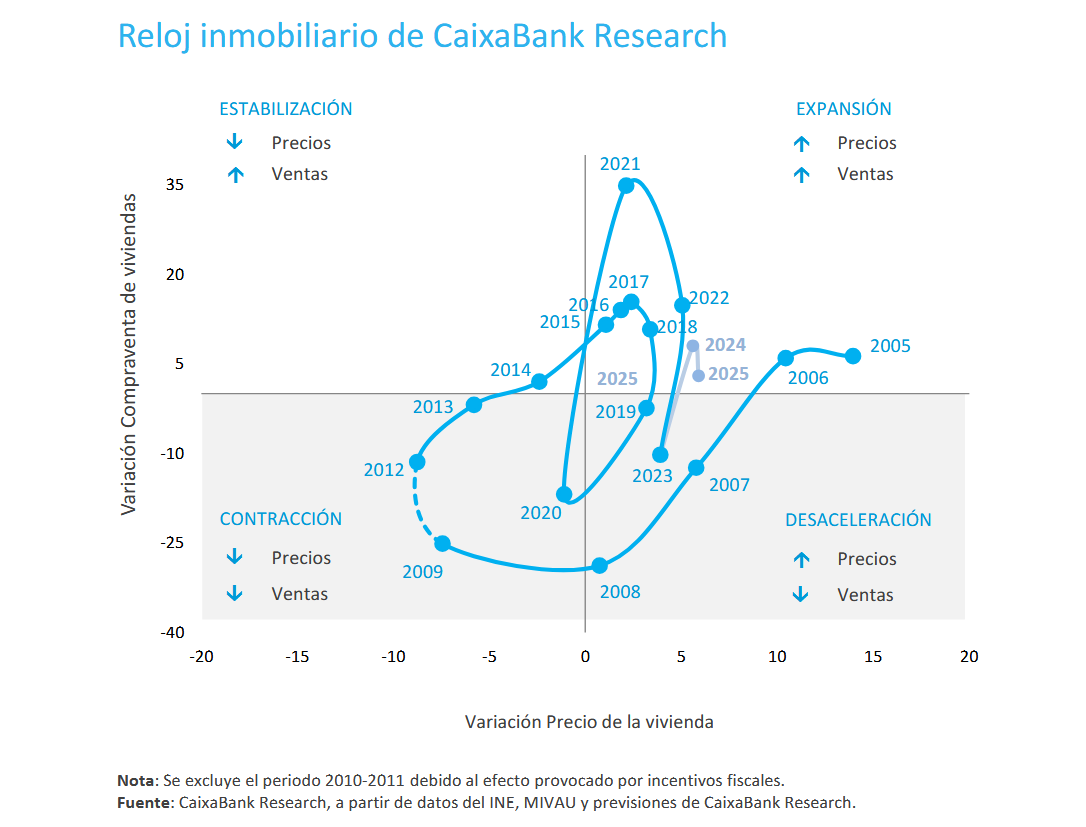

CaixaBank Research's "real estate clock" predicts a bullish 2025 for both home sales and prices, indicating another expansionary year.

"The various factors driving demand will remain in place. The ECB will continue to reduce interest rates, household income is expected to regain purchasing power, and the population is also anticipated to keep growing," said the bank's economists.

As a result, they warn that the rise in prices will further worsen access to housing in Spain, as it will outpace the expected increase in household disposable income. Consequently, families will need to spend 7.5 years of full income to afford an average home, compared to 7.2 years in 2024. This figure is in line with that of 2022, though still well below the record of 9.4 years reached in 2007.