On Monday 17th June 2019, a new mortgage law came into force in Spain, having arrived late and with many changes, such as an article that is generating a lot of uncertainty in the Spanish real estate sector. This is Article 20, which allows non-residents who apply for a mortgage in Spain to change it from the euro to their local currency at any time. Notaries and industry experts warn that it could reduce the number of mortgages that are granted and, therefore, mean fewer property purchases by expats from outside the eurozone.

Specifically, Article 20 of the Real Estate Credit Act (Ley de Crédito Inmobiliario) allows any future mortgages which are taken out by expats from countries outside the euro area, like the USA and UK, to change their mortgage into another currency in two specific cases:

- If the currency in which the borrower receives most of their income or has the most assets with which to repay the loan is not the euro, as indicated at the time of the most recent credit assessment for the loan contract.

- If the currency of the country where the person may have moved to work is not the euro. For example, if it is India or China, you can ask to repay the fees in rupees or yuan.

Fernando Encinar, Head of Research at idealista, points out that this is "a major obstacle to granting mortgages to foreigners who are not part of the eurozone. With this new law, the client has the right to request that at any time the mortgage be converted to their local currency, and this involves a risk with the exchange rate that isn’t provided for in the pricing of the products of banks operating in Spain and would involve a high level of technical complexity.”

Article 20 also brings another new feature for getting a mortgage in Spain and that is that if the bank fails to comply with the customer’s request, the law says that "the nullity of multicurrency clauses" will be determined. This means that the loan will be considered to have been granted in the currency in which the client receives the main part of their income from the very beginning.

"The big difference with multi-currency mortgages in Spain is that it before the currencies between which the borrower could change were clearly defined, whereas with the new law the currencies are not limited,” says Juan Villén, manager of the idealista/hipotecas mortgage service. “It depends on where the applicant works or where they move to work so they can ask that the mortgage payments be transferred to the currency of that country.”

Sources from one of the main banks in Spain have assured idealista/news that they are waiting for the Ministry of Economy or the Bank of Spain to clarify properly what this article consists of. They point out that its wording is very confusing and diffuse, although they don’t expect to have many requests from foreigners asking to change the currency of their mortgage repayments.

The Spanish Mortgage Association (Asociación Hipotecaria Española or AHE) also highlights the lack of information in Article 20. "It is worth noting that it says nothing about the interest rate at which the conversion is made, i.e. the price and the new conditions of the loan, and it should not be taken for granted that they will be the same.”

The AHE highlights two main groups to which this rule would apply:

- Spaniards who have or are going to get a mortgage in a foreign currency (usually Swiss francs or Japanese yen) and have acquired a property in Spain (these are the cases that have dominated the debate regarding this type of loan).

- Non-Spaniards who already have or will get a mortgage in their local currency (not euros) to buy property in Spain.

How the new law will affect the Spanish property market

Although the number of transactions affected by Article 20 is very small in the market as a whole, notaries and banks are expectant. Some banks might even stop financing this type of mortgage, according to sources consulted by idealista/news. The AHE points out that "there is nothing to suggest that its importance will increase in the immediate future".

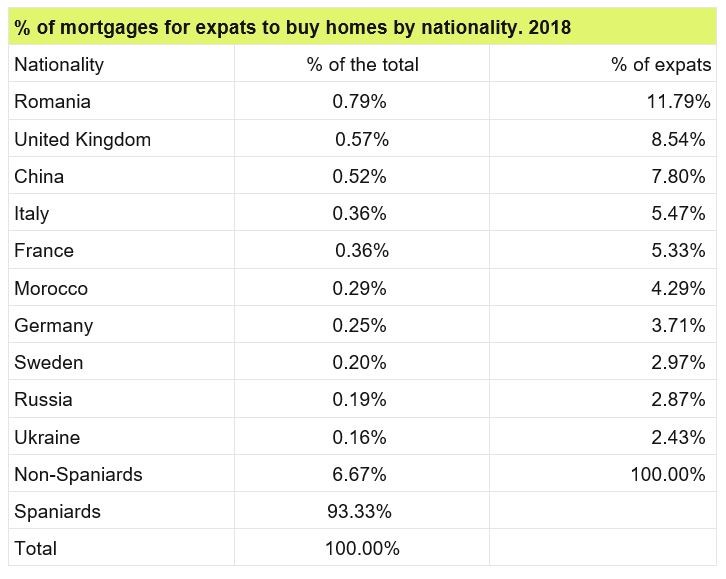

The number of loans to expats by Spanish banks is also very small, but they have more than doubled since 2013 from 10,315 to 23,090 mortgages in 2018. The only body that publicly offers data on mortgages granted to foreigners is the College of Registrars in Spain. In 2018, 6.6% of the total loans granted to buy a house went to expats and 93.3% to Spaniards. In other words, 23,090 new mortgages were signed for foreigners out of a total of 346,366 loans, more than ever before.

Within the total number of loans granted to expats in Spain, Romanians are the nationality with the greatest weight, with 11.79% of the total mortgages. Nonetheless, Romanians come sixth in the ranking of number of properties purchased in the country by non-Spaniards. Therefore, we can deduce that it is a nationality that resorts to mortgage financing more than the rest, and that they may face more problems when financing a property purchase with the new mortgage law because Romania is not part of the eurozone.

The same goes for the British, who are the second biggest customers for Spanish mortgages with 8.54% (and 15.54% of home purchases by expats in Spain). In third place are the Chinese with 7.80% (3.94% in home purchases).

Then there are Italians with 5.47% (5.38% in house purchases) and the French with 5.33% (7.39% in house purchases).

By Autonomous Community, the regions of Spain with the highest share of the national total of non-resident housing mortgages in 2018 were Catalonia (20.97%), Valencia (19.69%), Andalusia (17.17%) and Madrid (14.59%). The rest of the Autonomous Communities had results below 10%, with the highest amounts going to the Balearic Islands (7.26%) and the Canary Islands (6.03%). The leading nationalities for the most houses bought in Spain are generally have high levels of per capita income, providing lower financing needs, as shown in the results of taking out mortgages on housing.

See mortgages in Spain for non-residents from idealista/hipotecas