On buying a home in Spain, the first point is to determine whether you are buying new build (off-plan or sobre plano, in Spanish) or else a resale (second-hand property or reventa, in Spanish). Two different sets of taxes apply depending on which property type you acquire.

In addition to the above, Spain’s 17 autonomous regions have devolved competencies on tax matters which allow them to approve – within limits – their own tax rates within a sliding scale. This means that a resale property that is sold, for example, in Madrid will not have the same applicable tax rates as one sold in Mallorca as they are both located in different regions subject to different tax rates.

This is why we strongly recommend that a buyer should pre-empt this scenario by requesting from their appointed lawyer a breakdown of taxes and associated expenses, to budget carefully for the conveyance procedure and avoid nasty last-minute surprises (this advice applies likewise on selling, by the way!). Unless you instruct a lawyer, they do not normally provide these tax breakdowns for free.

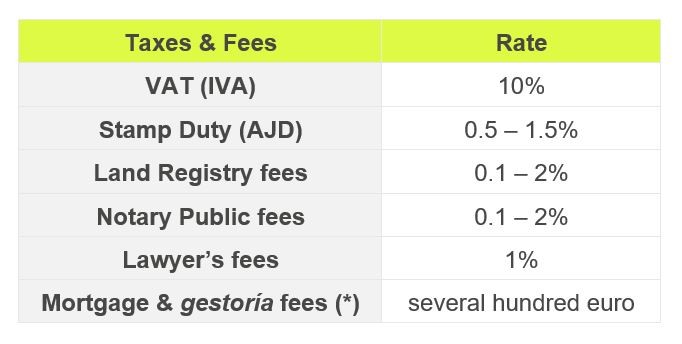

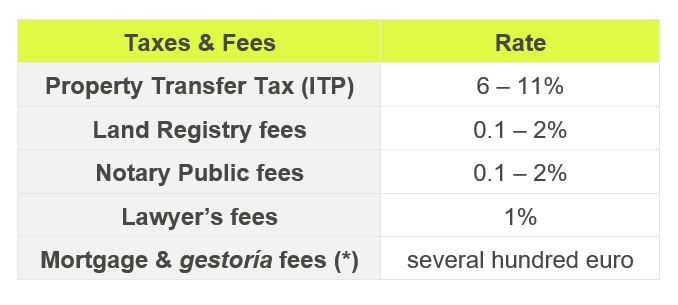

As a rule of thumb, purchase costs add 10-13% over and above the asking sales price. We collate below the most usual taxes and associated fees on buying property in Spain. Again, we stress that the below charts are merely a generalisation; please take concrete legal and tax advice on your particular matter. All fees have VAT on top.

1. New-Build or Off-Plan Property

2. Resale Property

Once you buy a home in Spain, there are several post-completion taxes and ongoing maintenance costs you should be aware of, including annual taxes and insurance.